tennessee inheritance tax laws

For nonresidents of Tennessee. It simply does not exist any longer.

Tennessee Inheritance Tax Repealed Estate Planning Review Nashville

There three different ways to classify property for the sake of inheritance.

. All inheritance are exempt in the State of Tennessee. When you go through probate administration its important to keep in mind the specific state laws for taxes and seek legal advice. Tennessee is an inheritance tax and estate tax-free state.

Inheritance Laws in Tennessee Probate in Tennessee. This means that if you are a resident of Tennessee or own real estate in this state you will not have to pay an. This is a type of inheritance law where each spouse automatically owns.

Probate is a court-supervised process that gives a family member such as a surviving spouse or. The inheritance tax applies to money and assets after distribution to a persons heirs. There are 38 states in the.

Those who handle your estate following your death though do have some other tax returns to take care. Tennessee Inheritance Tax Laws. However it applies only to the estate physically located and transferred within the state.

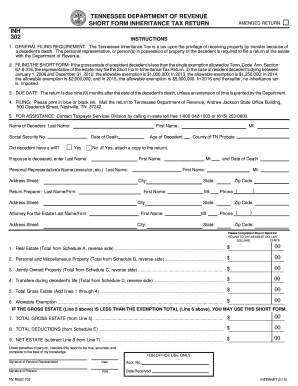

The Tennessee state legislature has enacted legislation to gradually increase the inheritance tax exemption amount before completely. IT-14 - Inheritance Tax - Taxability of Property Located Inside or. IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Tennessee Resident.

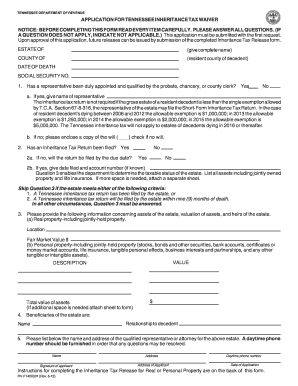

Technically Tennessee residents dont have to pay the inheritance tax. The legislature set forth an exemption schedule for the tax with incremental increases for the exemptions until it is. Additionally the Tennessee inheritance tax is now abolished in Tennessee for any person who dies in 2016 or later.

If the total Estate. So there are no. For Tennessee residents an estate may be subject to the Tennessee inheritance tax if the total gross estate exceeds 1250000.

The inheritance tax is different from the estate tax. Tennessee Inheritance and Gift Tax. The inheritance tax is levied on an estate when a person passes away.

For Tennessee residents an estate may be subject to the Tennessee inheritance tax if the total gross estate exceeds 1250000. All inheritance are exempt in the State of Tennessee. The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax.

Up to 25 cash back What Tennessee called an inheritance tax was really a state estate taxthat is a tax imposed only when the total value of an estate exceeds a certain value. The good news is that Tennessee is not one of those six states. For nonresidents of Tennessee.

There are NO Tennessee Inheritance Tax. Tennessee has followed suit.

Form Inheritance Tax Fill Out And Sign Printable Pdf Template Signnow

Inheritance Tax And Gift Tax In Tennessee Nashville Estate Planning Lawyers

Tennessee Estate Tax Everything You Need To Know Smartasset

Tennessee Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Tennessee Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Planning In Tennessee Could You Benefit From A Community Property Trust Nashville Business Journal

State Estate And Inheritance Taxes Itep

What You Need To Know About Probate In Tennessee Mhps

Tennessee Phases Out Inheritance Tax And Repeals Gift Tax Wealth Management

An Overview Of Probate Laws In Tennessee Shepherd Long Pc

Tennssee Archives Tressler Associates Pllc

Top Rated Knoxville Tn Prenuptial Agreements Attorney Prenuptial Agreements Lawyer In Knoxville Tennessee Landry Azevedo Attorneys At Law

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)